Tax Summary report

Tax summary report

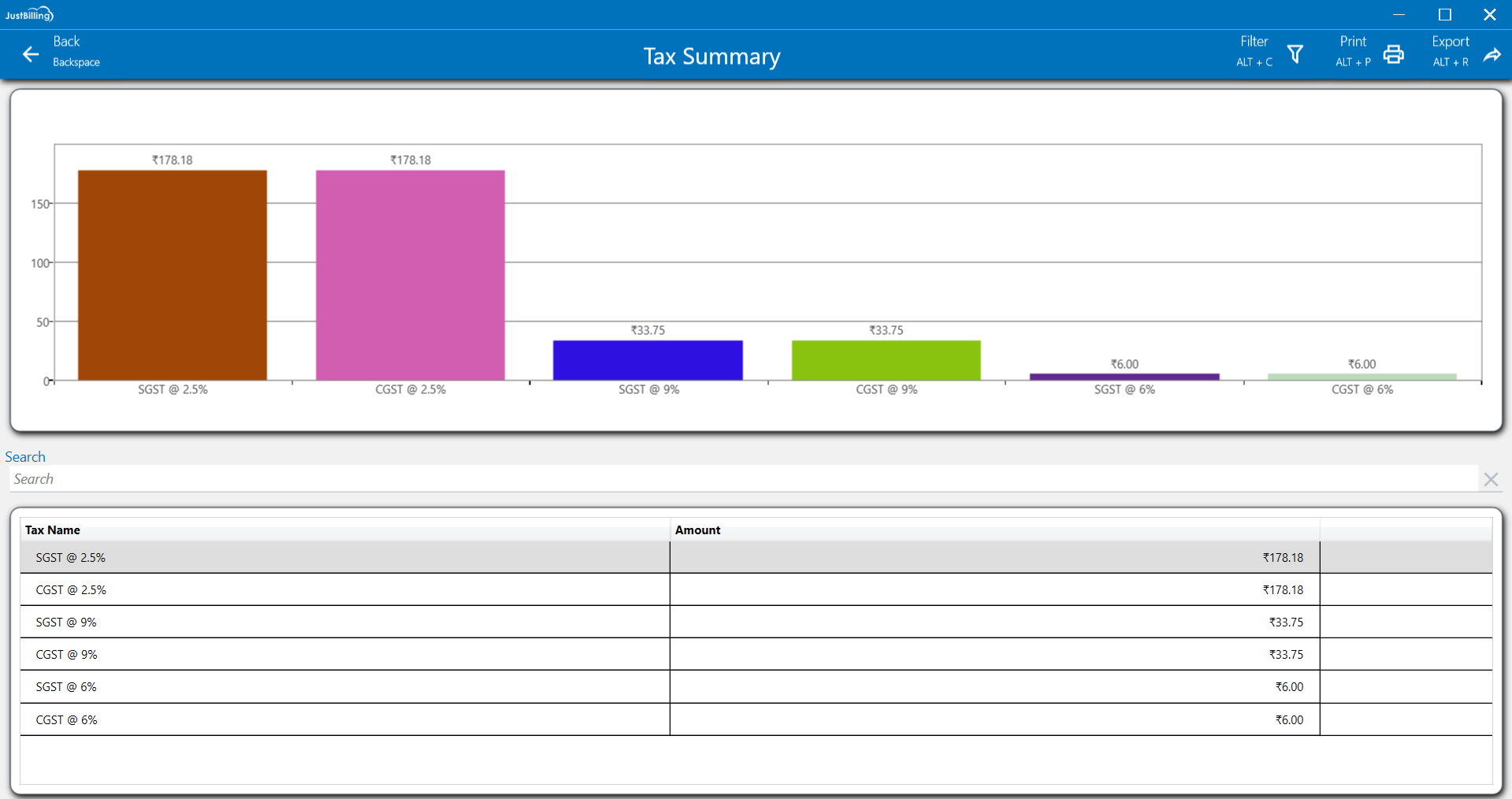

This "Tax Summary" report provides a clear overview of your collected taxes. It details the amounts for SGST and CGST at different rates, like 9%, 2.5%, and 1.5%. You can quickly see how much tax you've collected in total for each category.

(Figure 1 - Tax summary report)

From this report users can see the tax summary for the invoices generated.

Customize layout: You can customize the layout by expanding column sizes and moving columns to your preferred order and right click on the column to get personalized options.(See figure below)

(Figure 2 -Customize layout)

Filter: To refine the report view, click on the Filter option located in the top-right corner of the screen. You can then select a particular date range to narrow down the displayed data. This functionality allows you to focus on a specific period, making it easier to analyze and find the transactions you need.

(Figure 3 - Filter report data)

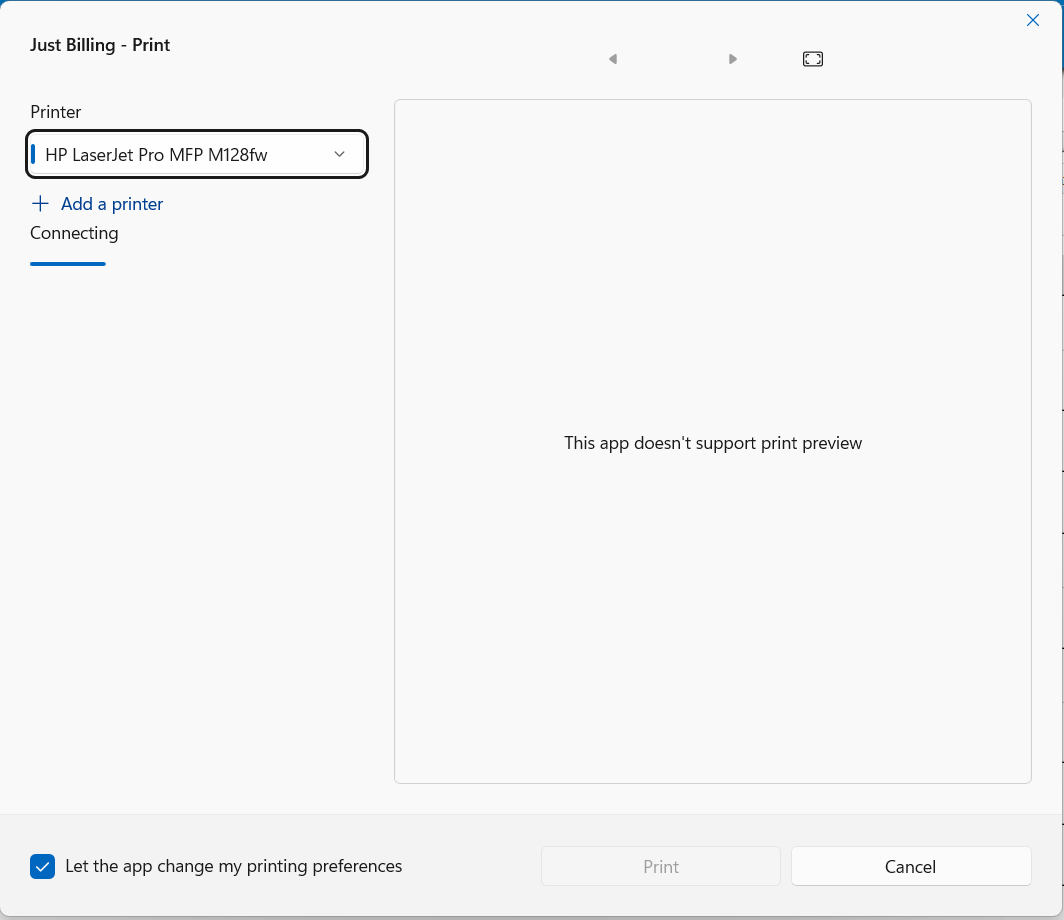

Print: Click on the Print option to create a physical copy of this detailed report.

(Figure 4 - Print Report)

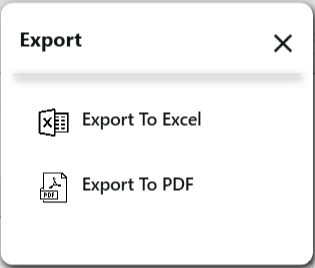

Export: To save the report, click the Export option. You can then choose to export the data to an Excel file or as a PDF document for easy sharing.

(Figure 5 - Export Report)