Tax rates

Tax Rates

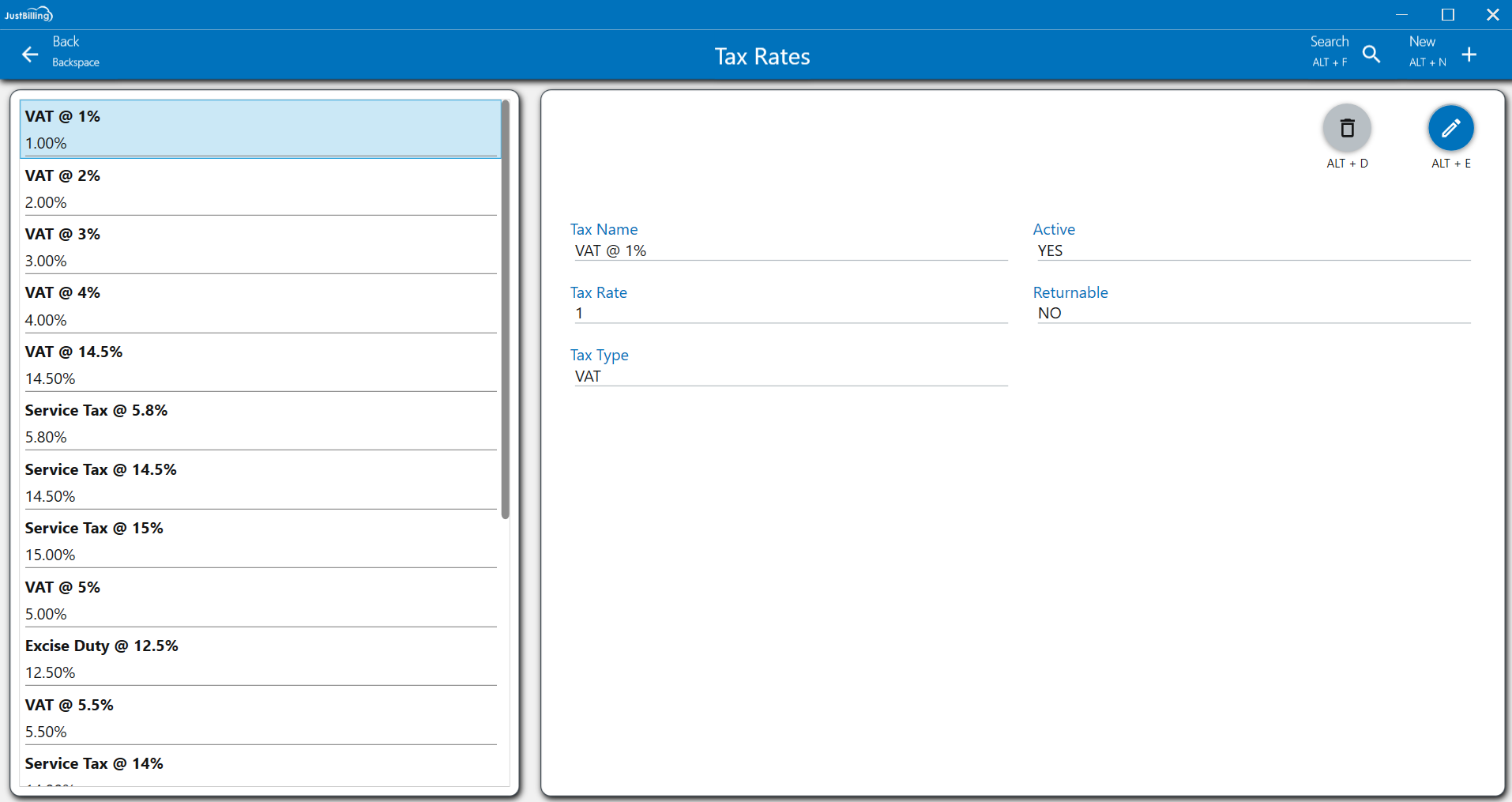

From this page, users can View, Add and Edit the list of Tax Rates (see figure 1).

In this section you can see how to Add and Edit a tax rates.

(Figure 1 - Tax Rates page)

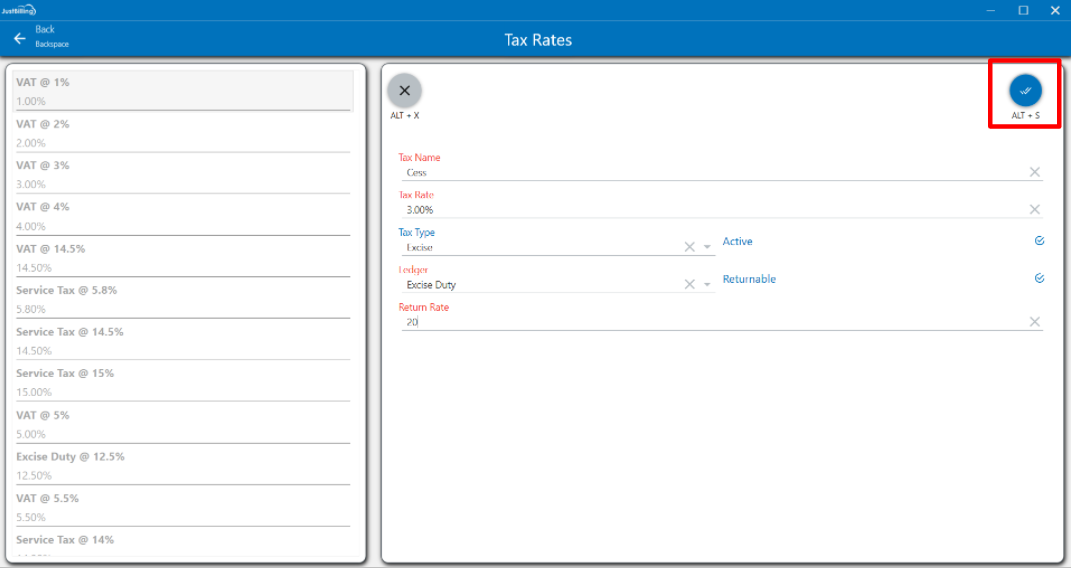

How to create a new Tax Rates ?

To create a new Tax Rates , you need to log into Just Billing Application in your desktop.

1. Navigate the page to from Menu > Masters > Tax Rates (see figure 2 ).

2. Click on New+, Enter Tax Rate name

3. Enter Tax Rate

4. Select Tax type from list of taxes types VAT, Service tax, Service charge, Excise and others

5. Select GL Code from list of general ledgers available VAT, Service Tax, Excise

6. Check the box make tax rate active

7. Check the box if the tax rate is returnable

8. Save the details

(Figure 2 - Adding Tax rates in JB Windows Application)

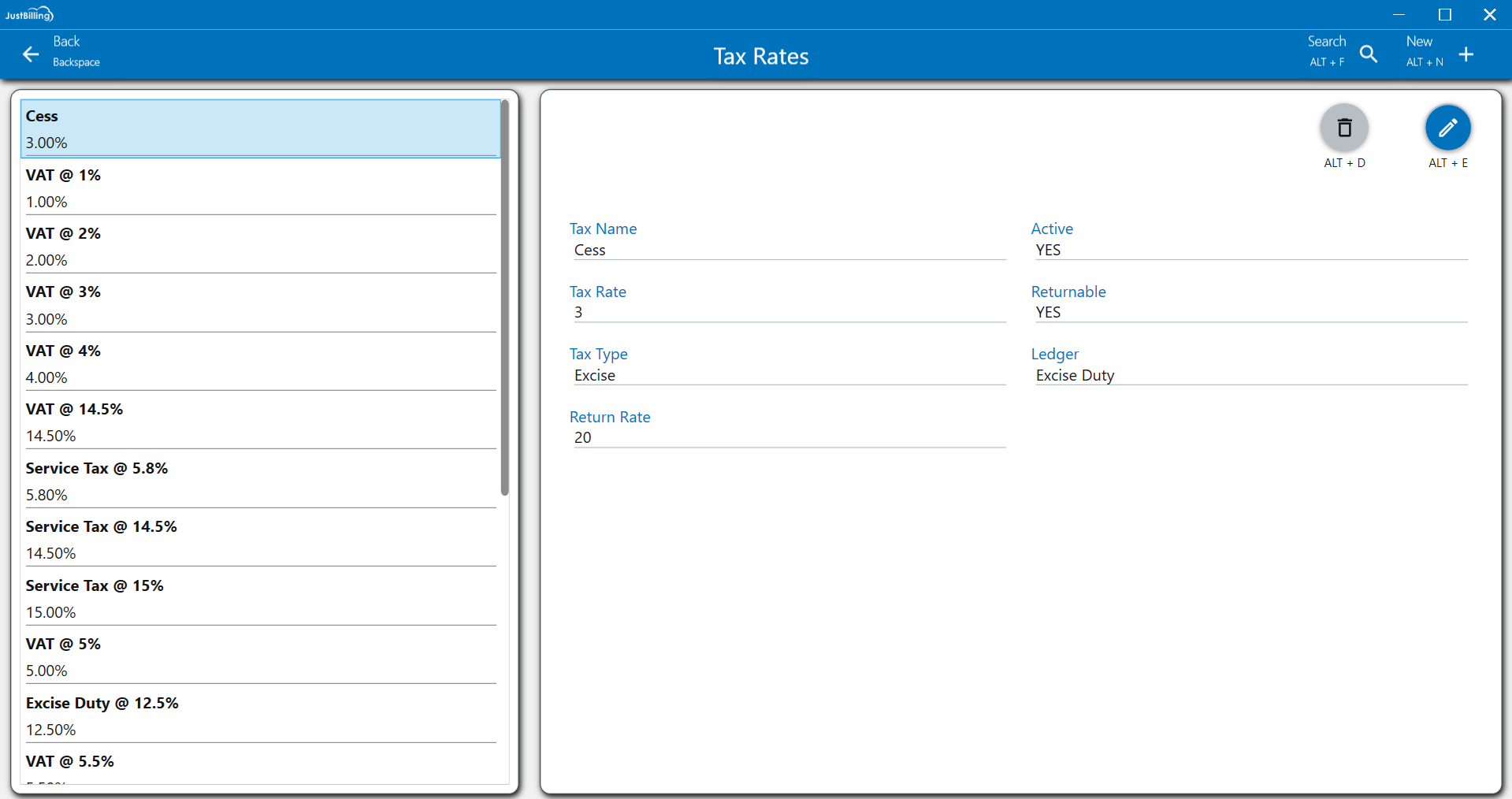

9. On saving, the Tax rate reflects in the JB Windows application under the Tax rates page.

(Figure 3 - Saving Tax rates in JB Windows Application)

Note: Tax rates page added from Just billing application will get synced to JB cloud Back office by Auto Sync.

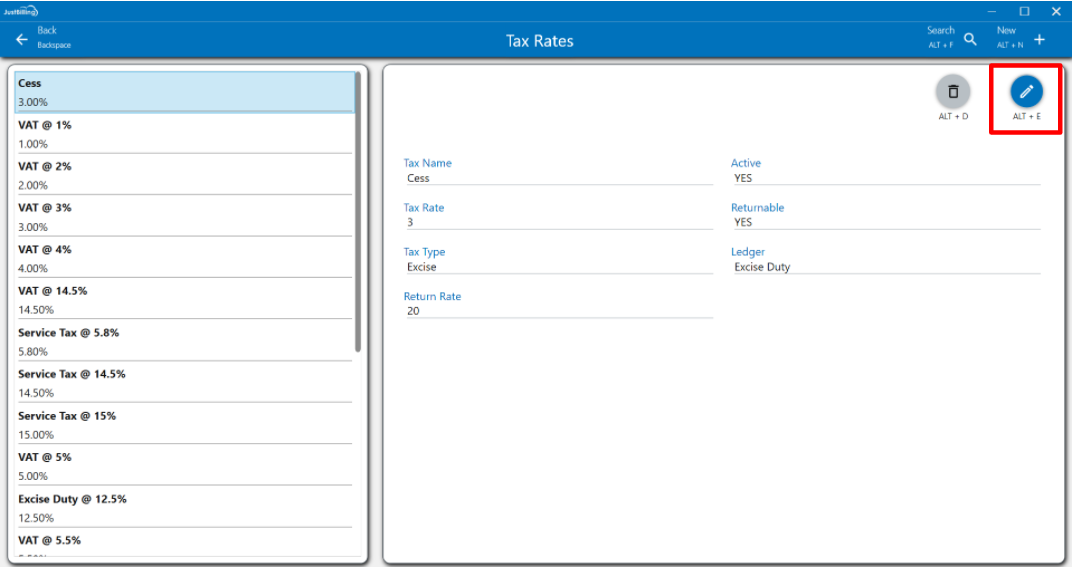

How to edit a Tax Rates ?

1. Navigate the page to from Menu > Masters > Tax rates

2. Select a Tax rate from list of tax rates available

3. Click on Edit, Enter the details need to be Edited/ Updated

4. Then Save the details

5. On Saving, the Tax rate page is updated and reflects in JB Windows application under discount rules page.

(Figure 4 - Editing Tax rates in JB Windows Application)

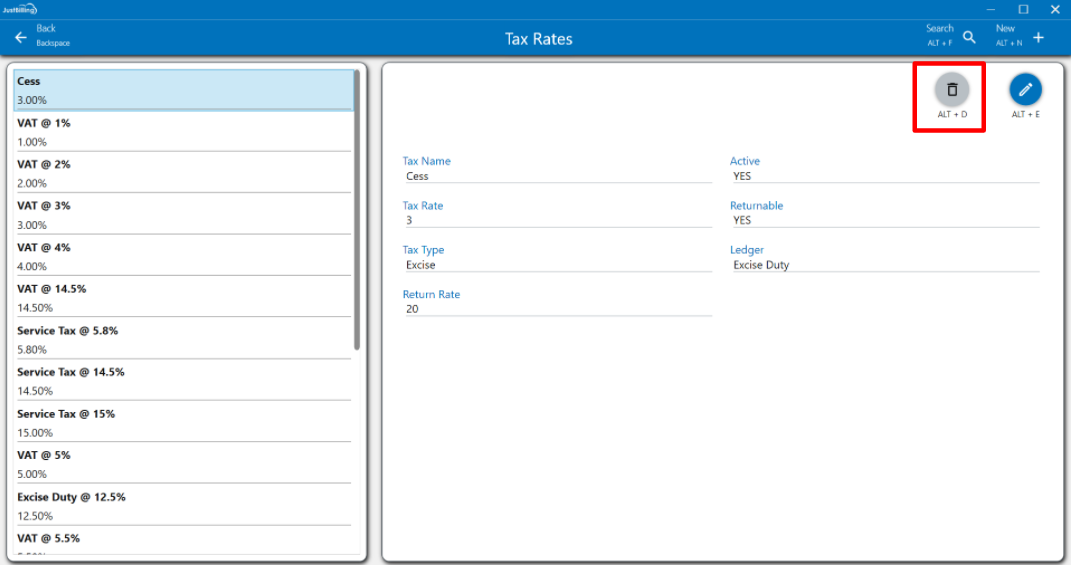

How to delete a Tax rates ?

1. Click on delete button or press Alt+D

2. Click on Yes to delete the tax rate, then the tax rate will be deleted.

(Figure 5 - Delete Tax rates in JB Windows Application)

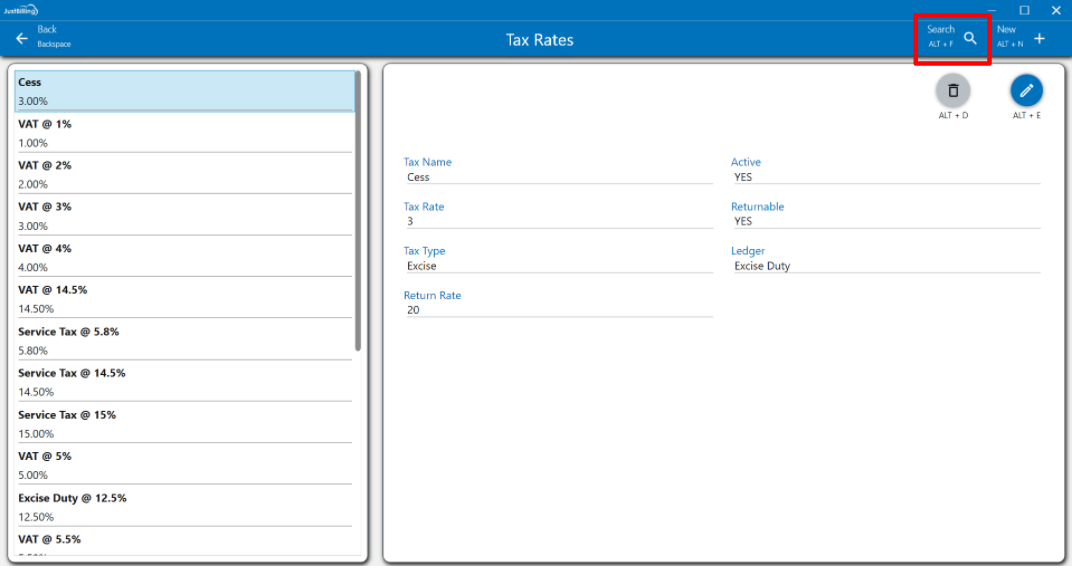

How to search a Tax rates ?

1. Place the cursor on search field

2. Enter the Tax rate name of Tax rate so that it will filter the results

3. Select the Tax rate from the filtered results

(Figure 6 - Search Tax rates in JB Windows Application)

Fields in this page are :

- Tax Name : ( From this option you can enter tax rate name )

- Tax Rate : ( From this option you can enter the Tax rate )

- Tax Type : ( From this option you can select the Tax type )

- GL Code : ( From this option you can select the general ledger code )