Tax Payments

Tax Payments

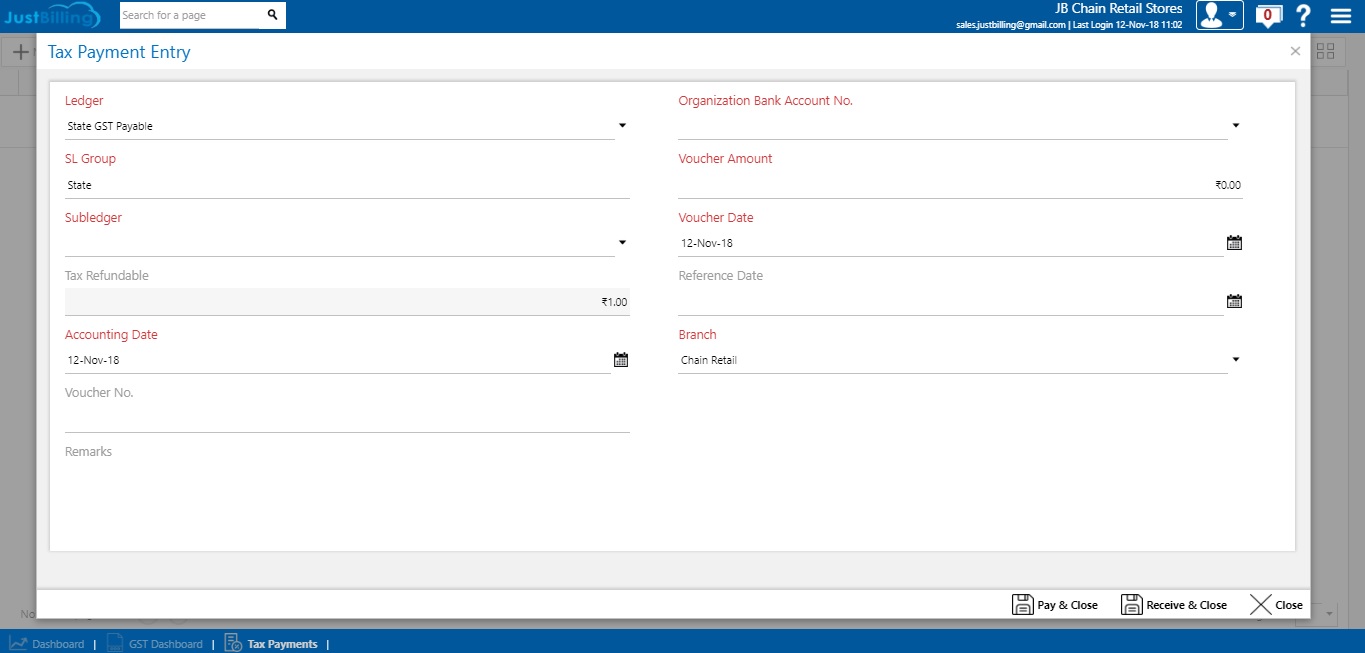

The Tax Payments page lets you manually enter the Tax Payment Entries for Tax Ledgers. ( Figure 1 - Tax Payment Entry )

(Figure 1 - Tax Payment Entry Pop up )

To add Tax Payment Entry, click on the add button on the toolbar. The following pop-up will appear. Enter the information as explained below and click on save once done.

Different fields in this page are:

Ledger : select the ledger from the selected ledger group for which opening balance entry is to be made

SL Group : select the sub ledger group under the general ledger for which opening balance entry is to be made

Sub Ledger : select the sub ledger from the selected sub ledger group for which opening balance entry is to be made

Accounting Date : it displays by default the current financial year

Tax Refundable : enter tax refundable amount if applicable

Voucher Number : Enter Voucher number if you are paying to your partners with any vouchers

Organisation Bank Account No : Select Organisation bank account no

Voucher Amount : Enter the amount that you are paying through vouchers

Voucher Date : Select the date of voucher

Reference Date : Select the reference date

Branch : Select the branch for which you are paying Tax Payment

Remarks : Enter the remarks that you have.